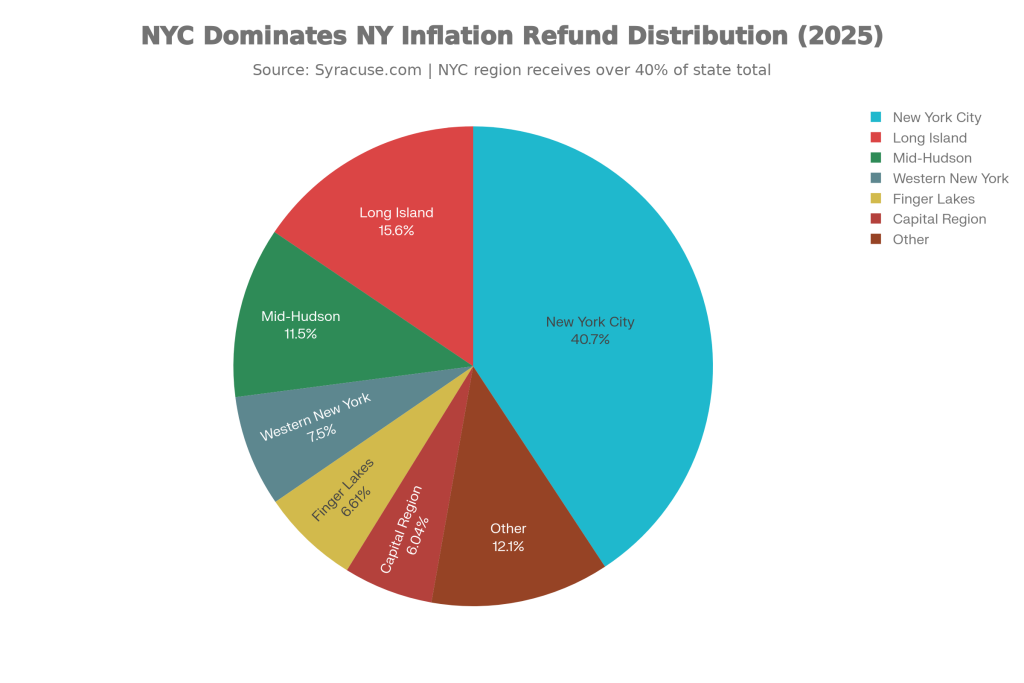

If you’ve been hearing buzz about a $400 Inflation Refund Check, here’s what’s actually happening. This isn’t a new federal stimulus program, and it isn’t something every American automatically qualifies for. It’s a state level payment being mailed to eligible taxpayers, mainly to help offset the sting of higher day to day costs that have lingered even as inflation has cooled from recent peaks.

The $400 Inflation Refund Check has one big goal put a little money back into the hands of people who filed a qualifying state tax return and meet specific rules. The key thing most people miss is that eligibility is based on your tax filing and residency status, not just citizenship. If you qualify, you don’t need to apply, sign up, or share personal information with anyone. The payment is sent automatically, and it comes as a mailed paper check.

Table of Contents

$400 Inflation Refund Check

| Topic | Details |

|---|---|

| Payment name | Inflation refund check |

| Maximum amount | Up to 400 dollars |

| Who it’s for | Eligible full year residents who filed the required resident income tax return |

| Key eligibility limits | Income thresholds vary by filing status; must not be claimed as a dependent |

| Application required | No |

| Payment method | Mailed paper check |

| When payments are sent | Mailed in waves starting in late September 2025, continuing through the following weeks |

| Best way to avoid issues | Ensure your mailing address is current with the tax department |

Who’s Eligible For An Inflation Refund Check?

Eligibility is straightforward once you know what the state is looking at. This payment is designed for people who filed a resident state income tax return for the required tax year and meet income and dependency rules.

In general, you may qualify if:

- You filed a resident income tax return for the qualifying year

- You were a full year resident of the state during that year

- You fell within the program’s income limits based on your filing status

- You were not claimed as a dependent on someone else’s tax return

There’s no special category you need to belong to, and there’s no requirement like being a senior citizen, a parent, or unemployed. It’s primarily a tax return-based benefit. This is often discussed like it’s for U.S. citizens, but the practical filter is state residency and state tax filing. If you weren’t a full year resident, you can be a U.S. citizen and still not qualify and if you were a full year resident but didn’t file the required return, the state generally has no way to confirm eligibility for this particular refund.

Which U.S. Citizens Qualify and When Payments Are Sent

Let’s answer the headline question in plain English. The $400 Inflation Refund Check is tied to a specific state program and applies to eligible taxpayers in that state, not to every U.S. citizen nationwide. So the “which citizens qualify” part really means “which residents who filed the right return qualify.”

Here’s what that means for most readers:

- If you lived in the state full time during the qualifying tax year and filed the required resident return, you’re in the pool for eligibility review.

- If your income falls within the state’s limits for your filing status, your payment amount is determined accordingly.

- If you were claimed as a dependent, you generally won’t get your own check because the program focuses on taxpayers who are not dependents.

- If you were a part year resident, you typically won’t qualify, even if you worked in the state or had state source income.

And now the other half: when payments are sent. Checks started going out in waves, not all at once. That’s why some households got theirs early while others are still waiting even though they appear eligible. The mailing schedule is spread over weeks.

Do You Need To Apply For The Inflation Refund Check?

No, This is one of the most important points because it protects you from scams.

- There is no application, no online form that you “must” submit, and no fee. If you qualify, the state sends the check automatically using the information from your tax records. So if you see ads, posts, texts, or DMs claiming you need to “register” to receive the $400 Inflation Refund Check, treat it as suspicious.

- A safe rule: don’t click links or share your Social Security number, bank login, or tax details with anyone who reaches out first. If you want to verify something, go directly to the official state tax website using your own browser, not a link.

When Will Checks Be Delivered?

Checks are mailed in batches, which means delivery timing will vary. Two people who look equally eligible on paper can receive checks at different times, simply because their payments were processed in different mailing runs.

A few practical things to keep in mind:

- The postal service delivery time can add extra days, especially during busy mail periods.

- If you recently moved, the check may go to your old address if your tax profile wasn’t updated.

- Some people may receive the check sooner because their tax return and address data were already clean and easy to match.

If you’re still waiting, it doesn’t automatically mean you’re denied. It often just means your batch hasn’t hit the mail yet or your address needs to be verified.

Where Will Your Inflation Refund Check Be Mailed?

- The check is mailed to the most current address the tax department has on file for you. In most cases, that means the address shown on your most recently processed tax return.

- This part matters more than people realize. Even if you qualify, a wrong address can cause delays, returned mail, or the check being delivered somewhere you no longer live.

- If you moved after filing, you should ensure your address is properly updated through the official tax account tools. Updating your address with the postal service is helpful, but it doesn’t always replace updating your address with the tax department.

Can You Update Your Address With The Department?

Yes. If you believe the state has an old mailing address for you, update it using the official online services portal associated with your tax profile.

When you update, double check:

- Spelling of street name and apartment number

- ZIP code

- Whether you used your new address consistently on recent tax filings

Also, avoid “third party helpers” who offer to change your address for a fee. This is a routine update you can generally do yourself through the official system.

Will The Payment Be Direct Deposit Or A Paper Check?

- This is another point that causes confusion. Many taxpayers assume that if they usually get refunds by direct deposit, then this payment will show up the same way.

- For this inflation refund, the payment is sent as a paper check through the mail. That’s why checking your mailbox matters more than checking your bank balance for this particular benefit.

- If you’re worried about mail security, consider using informed delivery features offered by your postal service or ensuring your mailbox is secure, especially in apartment buildings.

What If You Didn’t File a Resident Return

- If you didn’t file the required resident income tax return for the qualifying year, you usually won’t receive this check. The state uses that return to confirm residency status and income eligibility. Without it, the system typically has no basis to approve a payment.

- If you believe you should have filed but didn’t, you may want to speak with a qualified tax professional about whether filing a late return is appropriate in your situation. Just keep expectations realistic: late filing doesn’t always mean you’ll be included in a past mailing cycle.

What If You Were A Part Year Resident With State Source Income?

Part year residents are commonly excluded from this type of refund program because the state restricts it to full year residents.

So even if you:

- worked in the state for a few months,

- moved in or moved out mid year,

- had state taxes withheld,

you may still be ineligible if you were not a full year resident for the qualifying tax year. This is frustrating for some people, but it’s one of the clearest eligibility lines the state draws.

Will The Inflation Refund Be Taken For Outstanding Debts?

Many people ask this because they’ve had tax refunds reduced in the past due to debts or other obligations. The inflation refund program states that the amount is not applied to outstanding debts, meaning the check is intended to reach eligible taxpayers directly rather than being intercepted the way some refunds can be. If you’ve had offsets before, this rule is a major reason this payment feels different from a standard refund.

How To Avoid Scams And Misinformation

Whenever a widely shared payment headline circulates, scammers take advantage. The $400 Inflation Refund Check is no exception.

Here’s how to protect yourself:

- Don’t trust messages that claim you must “confirm” your Social Security number to receive the check

- Ignore posts promising “instant approval” or “same day deposit”

- Don’t pay anyone to “release” your funds

- Use only official government sites to verify details

- If you think you’re eligible, focus on address accuracy and waiting for mail delivery, not signing up

FAQs about $400 Inflation Refund Check

Is The $400 Inflation Refund Check A Federal Payment For All U.S. Citizens?

No. It’s a state level payment tied to eligibility rules based on residency and a qualifying resident tax return, not a universal federal benefit for all citizens.

How Much Will I Get If I Qualify?

Eligible taxpayers may receive up to 400 dollars, with the exact amount depending on filing status and income thresholds set by the program.

What If I Qualify but Haven’t Received Anything Yet?

Checks are mailed in waves, so timing can vary. If your address on file is correct, your check may simply be in a later batch or still in transit through the mail.

Can I Get The Payment By Direct Deposit Instead?

No. This payment is issued as a mailed paper check, even if your usual tax refund arrives by direct deposit.