The Department for Work and Pensions (DWP) has confirmed a significant UK Pension Update for Seniors, introducing adjusted payment schedules and uprated benefit frameworks effective from 1 January 2026. This shift precedes the broader April 2026 triple-lock increase, offering immediate clarity for millions of retirees navigating a complex fiscal landscape and rising living costs.

Table of Contents

UK Pension Update for Seniors

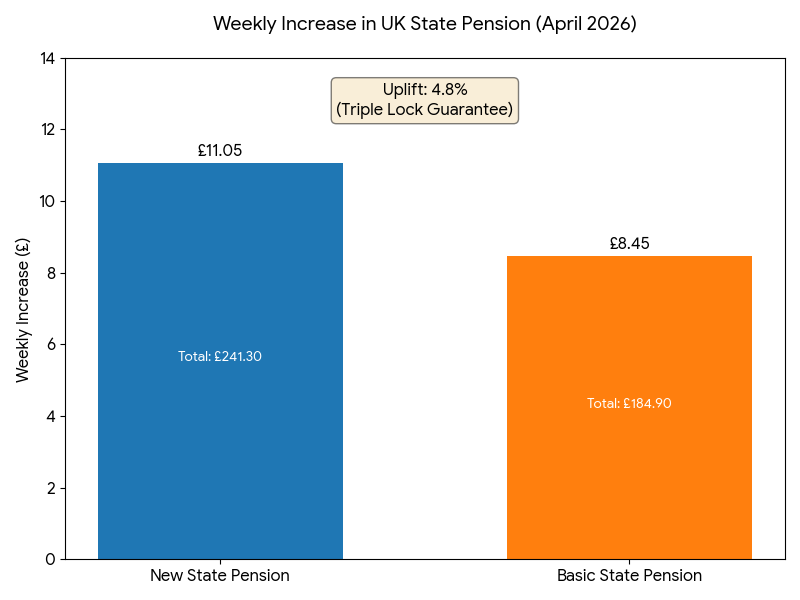

| Key Fact | Detail/Statistic |

| New State Pension Rate | £241.30 per week (from April 2026) |

| Basic State Pension Rate | £184.90 per week (from April 2026) |

| Triple Lock Uprating | 4.8% based on Earnings Growth |

| WASPI Compensation | Framework capped at £3,250 |

The DWP is expected to release further technical details regarding the compensation claims process in the coming weeks. For now, the government maintains that the 2026 updates represent a “firm commitment to dignity in retirement” despite the ongoing pressure of frozen tax thresholds.

DWP Announces Implementation of New Payment Frameworks

The Department for Work and Pensions (DWP) has formalised the rollout of its 2026 payment strategy, marking a critical juncture for the United Kingdom’s 12.7 million state pensioners. While the headline triple-lock increase of 4.8% is legally scheduled for the start of the new tax year in April, January 2026 serves as the operational launch for several key administrative changes.

Beginning 1 January, the DWP will initiate the formal eligibility assessment phase for the long-awaited WASPI (Women Against State Pension Inequality) compensation framework. This scheme, which follows years of parliamentary debate, is designed to provide financial redress to women born in the 1950s who were affected by “maladministration” regarding changes to their retirement age.

The Triple Lock and the 4.8% Increase

The government’s commitment to the triple-lock mechanism remains the cornerstone of the UK Pension Update for Seniors. Under this policy, the state pension rises annually by the highest of three measures: average earnings growth, Consumer Prices Index (CPI) inflation, or a baseline of 2.5%.

For the 2026/27 cycle, the Average Weekly Earnings (AWE) figure of 4.8%—measured between May and July 2025—outpaced the September CPI inflation rate of 3.8%. Consequently, the full new state pension will rise from £230.25 to £241.30 per week. Those on the basic state pension will see their weekly payments increase from £176.45 to £184.90.

“The commitment to the triple lock is vital to ensure that state pensions keep pace with wage growth and inflation,” said Sally Tsoukaris, General Secretary of the Civil Service Pensioners’ Alliance (CSPA). However, experts warn that these increases are bringing many retirees closer to the frozen Personal Allowance tax threshold of £12,570.

Eligibility Criteria for UK Pension and the New January Deadlines

The January 2026 window is particularly vital for those transitioning into retirement or claiming additional supports. The DWP has confirmed that January will mark the publication of final guidance for the £3,250 compensation framework. This process will require eligible individuals to verify their identity and pension communication history through a new digital portal.

Transitioning Benefits and “Managed Migration”

Furthermore, January 2026 sees the acceleration of “managed migration,” where claimants on legacy benefits are moved to Universal Credit. This process impacts “mixed-age couples”—where one partner is of pension age and the other is not—potentially altering their total household income.

According to Citizens Advice, the DWP is expected to issue “Migration Notices” throughout the first quarter of the year. Failure to respond to these notices within the three-month deadline could lead to a temporary cessation of payments, making the January updates essential for financial planning.

Fiscal Impact: The Tax Threshold “Sting”

While the cash increase is welcomed by advocacy groups, financial analysts point to a looming “stealth tax.” Because the Personal Allowance—the amount of income one can earn before paying tax—remains frozen at £12,570 until 2028, the new pension rates will consume nearly the entire tax-free limit.

- Full New State Pension (Annual): Approximately £12,547.60

- Remaining Tax-Free Buffer: Only £22.40

“Those with even a modest private pension or part-time earnings will find themselves paying the 20% basic rate of income tax on that extra income,” noted Martin Lewis, founder of MoneySavingExpert.com. This convergence means that while the DWP provides more, HM Revenue and Customs (HMRC) may reclaim a portion of the gains from millions of pensioners for the first time.

Future Outlook for State Pension Age

Speculation regarding a rise in the state pension age to 67 has been a point of contention. While current legislation schedules this increase between 2026 and 2028, recent government reviews suggest a “pause and re-evaluate” approach. Ministers have indicated that any further increases will consider regional health inequalities and life expectancy data rather than following an “automatic progression.”

DWP £562 Pensioner Payment – Who Born Before 1961 Qualifies and When the Money Is Paid

FAQs About UK Pension Update for Seniors

1. Will I get the pension increase in January 2026?

The administrative framework and certain compensation assessments begin in January, but the actual 4.8% increase in weekly payments takes effect on 6 April 2026, the start of the new financial year.

2. Who is eligible for the £3,250 WASPI compensation?

Eligibility is generally focused on women born between April 1950 and April 1960 who received insufficient notice regarding the change in their state pension age. Formal applications are expected to open in early 2026.

3. Do I need to apply for the triple-lock increase?

No. The annual uprating is applied automatically by the DWP to all existing state pension accounts. However, ensure your address and bank details are up to date.

4. Will the increase affect my eligibility for Pension Credit?

It may. Pension Credit is means-tested, so an increase in your state pension could potentially reduce the amount of Credit you receive. It is advisable to use a benefits calculator after the April changes.

5. How will I pay tax if my pension exceeds the Personal Allowance?

If you have a private pension, HMRC will typically adjust your tax code to collect the tax from that source. If the state pension is your only income, you may receive a “Simple Assessment” letter from HMRC detailing what you owe.