As housing costs continue to rise in Catawba County, local officials and housing advocates are urging more property owners to become a voucher-friendly landlord, allowing tenants to use federal rental assistance to secure housing. The approach, tied to the Housing Choice Voucher program, offers predictable payments and steady demand, but also brings inspections, paperwork, and regulatory oversight that landlords must weigh carefully.

Table of Contents

Voucher-Friendly” Landlord

| Key Fact | Detail |

|---|---|

| Program Name | Housing Choice Voucher (commonly called Section 8) |

| Local Administrator | Western Piedmont Regional Housing Authority |

| Tenant Rent Share | Typically ~30% of household income |

| Payment to Landlord | Monthly, direct deposit from housing authority |

| Inspection Requirement | Mandatory Housing Quality Standards (HQS) |

| Landlord Participation | Voluntary in North Carolina |

As Catawba County grapples with housing affordability, the role of the voucher-friendly landlord continues to draw attention from policymakers, property owners, and residents alike. Whether participation grows may shape how effectively federal housing assistance translates into real homes across the region.

What Does “Voucher-Friendly Landlord” Mean?

A voucher-friendly landlord is a property owner who agrees to rent to tenants using a Housing Choice Voucher, a federal subsidy designed to help low-income households afford private-market housing. The program is funded by the U.S. Department of Housing and Urban Development (HUD) and administered locally by public housing authorities.

The voucher does not cap landlords to government-owned housing or special developments. Instead, it allows eligible tenants to lease units in the open rental market, provided the property meets health, safety, and rent standards.

Housing officials emphasize that the program is designed to expand housing choice, not restrict landlords.

“The voucher follows the tenant,” one housing authority official explained. “But it only works if landlords are willing to participate.”

Why Voucher Demand Is Rising in Catawba County

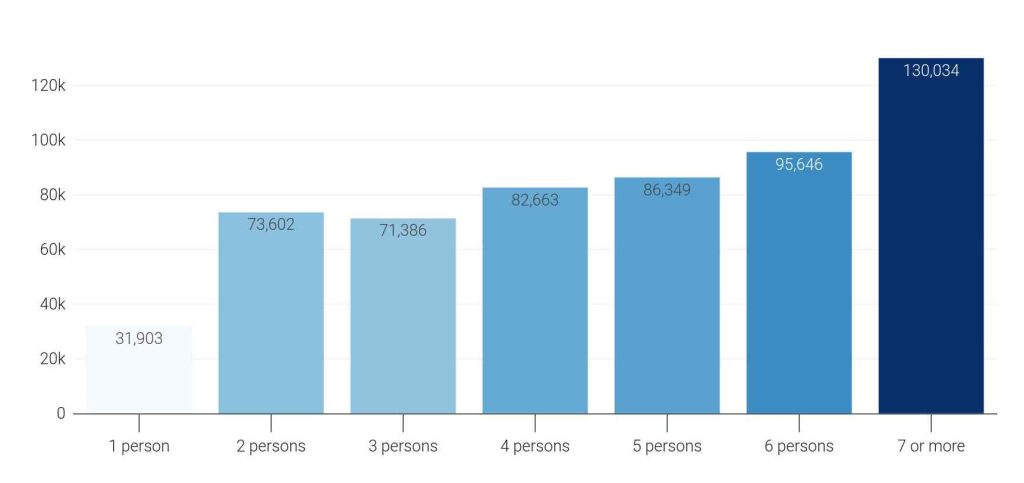

Catawba County’s rental market reflects broader national trends. Population growth, limited housing supply, and rising construction costs have pushed rents upward, while wage growth for many service and manufacturing workers has lagged behind.

According to county housing data, many households now spend more than 30 percent of their income on rent, a threshold widely used to define housing cost burden. For lower-income renters, that figure can exceed 50 percent.

Housing Choice Vouchers are intended to close that gap. However, long waiting lists mean assistance is only effective if units are available.

Who Runs the Program Locally

The Western Piedmont Regional Housing Authority administers the Housing Choice Voucher program for Catawba County and surrounding counties. The agency determines tenant eligibility, approves rents, conducts inspections, and issues monthly payments to landlords.

Landlords who participate sign two contracts:

- A standard lease with the tenant

- A Housing Assistance Payments (HAP) contract with the housing authority

The authority pays its portion of rent directly to the landlord, while the tenant pays the remainder.

How Landlords Get Started

Listing and Outreach

Landlords can advertise voucher acceptance through rental platforms, word of mouth, or housing authority referrals. Officials say clear communication upfront helps avoid misunderstandings later.

Many voucher holders actively search for properties labeled as Section 8 or voucher-friendly, particularly after long waits for assistance.

Tenant Selection and Screening

Contrary to common misconceptions, landlords retain control over tenant screening. Credit checks, rental history verification, and background screenings are allowed, as long as they are applied consistently and comply with fair housing laws.

A voucher does not guarantee tenancy. It guarantees a method of payment once a landlord agrees.

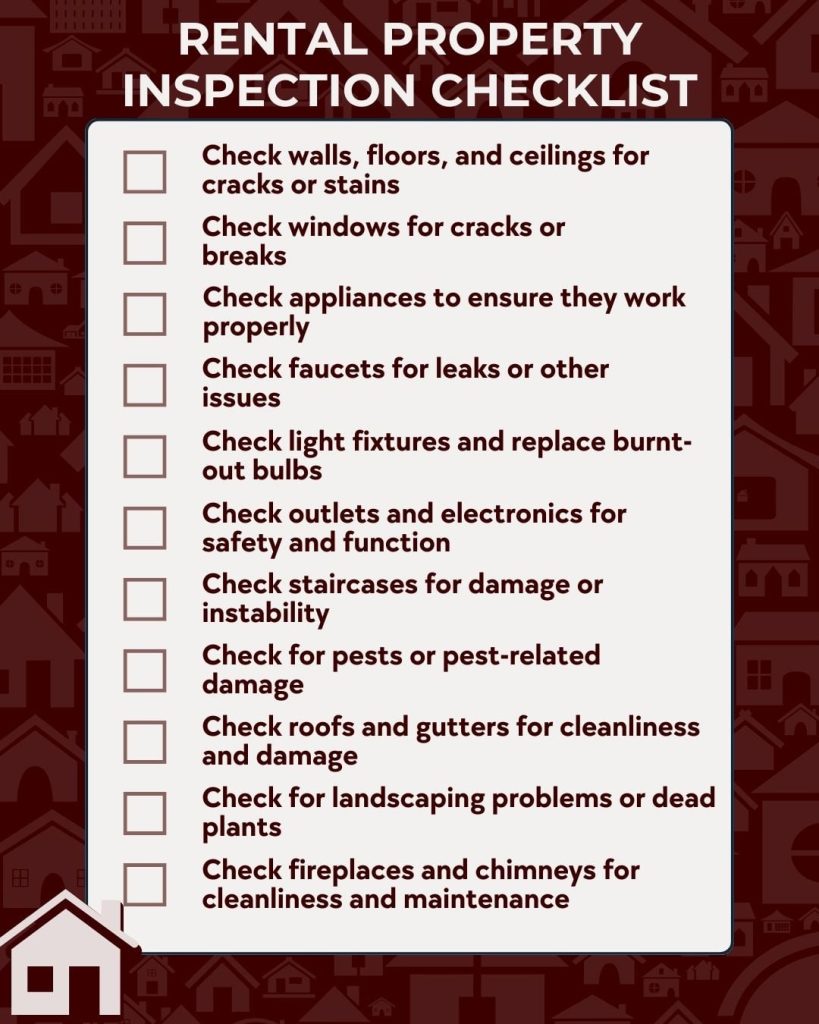

Inspections: What They Are and Why They Matter

Before a lease begins, the unit must pass a Housing Quality Standards (HQS) inspection. These inspections focus on basic safety and habitability, not cosmetic upgrades.

Key areas include:

- Working plumbing and electricity

- Secure doors and windows

- Functional heating systems

- Smoke and carbon monoxide detectors

If a unit fails, landlords are given time to make repairs. Housing officials note that most failures involve minor issues such as missing outlet covers or non-functioning smoke alarms.

Financial Stability Versus Administrative Burden

For many landlords, the program’s appeal lies in payment reliability. Once approved, housing authority payments are made consistently, even if a tenant experiences temporary income loss.

However, some landlords cite slower rent increases and inspection scheduling as drawbacks.

“It’s a tradeoff,” said a regional housing economist. “You get stability and demand, but you accept a more structured process.”

Common Myths and What Experts Say

Myth: Voucher tenants damage properties more often

Housing researchers say there is no evidence linking voucher use to higher property damage rates. Tenant behavior varies regardless of payment source.

Myth: The government controls the lease

Landlords use their own leases, with only limited required provisions added by the housing authority.

Myth: Inspections are excessive

HQS standards mirror basic building and safety codes already required in most jurisdictions.

Economic Impact on the Local Housing Market

Housing advocates argue that expanding voucher-friendly rentals can reduce homelessness, stabilize neighborhoods, and lower public costs associated with emergency shelter use.

From a landlord perspective, high demand can reduce vacancy periods. Voucher holders often wait months or years for assistance and are highly motivated to secure and maintain housing.

Local officials say small landlords—those with one to five units—are especially critical to meeting demand.

Legal Landscape and Fair Housing Rules

North Carolina does not currently mandate voucher acceptance statewide. However, landlords who participate must follow federal fair housing laws, including nondiscrimination based on race, disability, family status, or national origin.

Some housing advocates are pushing for broader “source-of-income” protections, though no such requirement currently exists at the county level.

Looking Ahead: Policy and Housing Supply

Catawba County officials say expanding housing supply remains the long-term solution. New construction, zoning changes, and rehabilitation of older units are all under discussion.

In the short term, officials see landlord participation as essential.

“Vouchers are already funded,” one housing administrator said. “What we need are doors willing to open.”

FAQ

Is becoming a voucher-friendly landlord mandatory?

No. Participation is voluntary.

How long does approval take?

Approval timelines vary, depending on paperwork completion and inspection scheduling.

Can landlords leave the program later?

Yes, with proper notice and lease compliance.