Fair Market Rents in Hickory define how much landlords can charge tenants using federal housing vouchers, influencing affordability for thousands of low-income households across western North Carolina. Updated annually by the U.S. Department of Housing and Urban Development, the figures set subsidy benchmarks for the Section 8 Housing Choice Voucher program in the Hickory-Lenoir-Morganton metropolitan area.

Table of Contents

Fair Market Rents

| Key Fact | Detail |

|---|---|

| Governing Agency | U.S. Department of Housing and Urban Development |

| Area Covered | Hickory-Lenoir-Morganton Metropolitan Statistical Area |

| Primary Function | Sets maximum subsidy benchmarks for Section 8 |

| Update Cycle | Annual (Federal fiscal year) |

As housing affordability remains a pressing issue nationwide, Fair Market Rents serve as both a technical benchmark and a reflection of broader economic pressures. In Hickory, their impact is felt most directly by families balancing limited incomes against an increasingly competitive rental market.

What Are Fair Market Rents?

Fair Market Rents, commonly referred to as FMRs, are estimates of what it costs to rent a modest, safe, and sanitary home in a specific region. HUD calculates them using recent rental data from private surveys, census sources, and housing market analyses.

The rents are set at approximately the 40th percentile of local market rents, meaning 40 percent of comparable units rent for less, while 60 percent rent for more. The approach is intended to strike a balance between giving voucher holders access to housing and preventing the federal government from inflating rents.

HUD emphasizes that FMRs are policy tools rather than market predictions, designed to support housing access rather than mirror the highest prices in a given area.

Fair Market Rents in Hickory for 2025

For fiscal year 2025, HUD established the following Fair Market Rents for the Hickory region:

- Studio: about $820

- One-bedroom: about $850

- Two-bedroom: about $1,045

- Three-bedroom: about $1,330

- Four-bedroom: about $1,565

These figures represent gross rent, which includes both the contract rent paid to the landlord and the cost of tenant-paid utilities such as electricity or water.

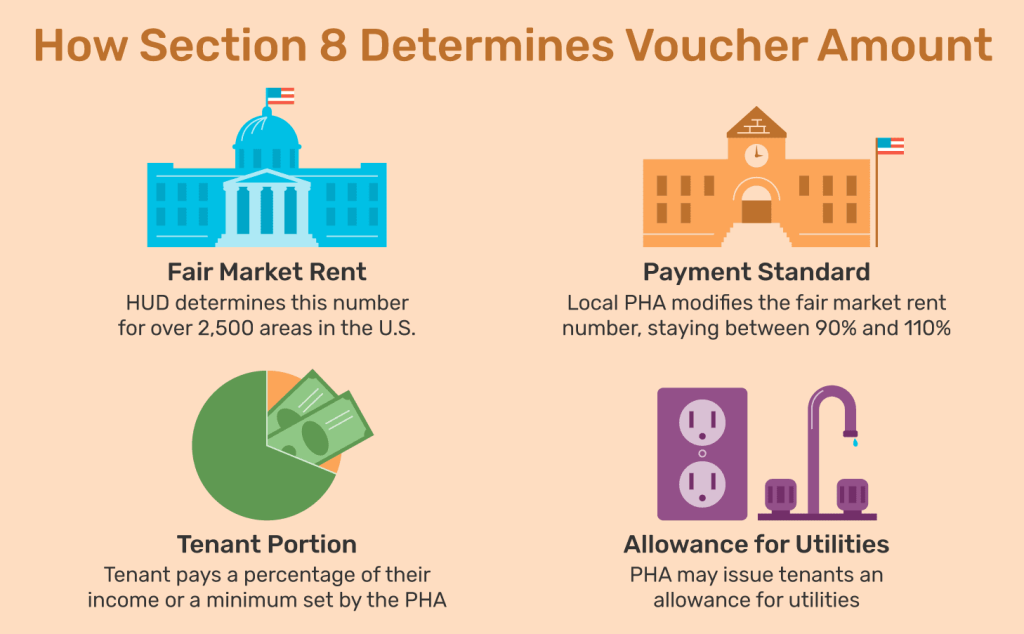

How Payment Standards Are Determined

While HUD publishes Fair Market Rents, local public housing authorities decide how they are applied. Most agencies set payment standards between 90 percent and 110 percent of the FMR, depending on budget constraints and market conditions.

In practice, this means the maximum subsidy available for a unit may be higher or lower than the published FMR. Housing authorities can also request HUD approval to exceed the 110 percent limit in areas where rents have risen sharply.

“The Fair Market Rent is the anchor, but the payment standard is the lever,” said a housing policy researcher familiar with voucher administration. “That flexibility helps agencies respond to local conditions.”

How Much Can Landlords Charge Section 8 Tenants?

Landlords participating in the Section 8 program may advertise rents at market rates, but approval depends on several factors:

- The rent must fall within the local payment standard.

- The unit must pass a rent reasonableness test, comparing it to similar non-subsidized units.

- The property must meet HUD’s housing quality standards.

If a landlord sets rent above the approved threshold, the unit will not qualify for subsidy, even if a tenant is willing to pay more.

What Tenants Typically Pay

Most Section 8 tenants contribute around 30 percent of their adjusted monthly income toward housing costs. The housing authority pays the remainder directly to the landlord.

However, tenants may pay more than 30 percent if they choose a unit priced above the payment standard, up to HUD-defined affordability limits. Advocates caution that higher tenant shares can increase the risk of housing instability.

The Role of Utility Allowances

Utility allowances often determine whether a unit is financially viable for voucher holders. When tenants pay utilities separately, housing authorities deduct an estimated allowance from the payment standard.

For example, a two-bedroom unit priced at the FMR may become unaffordable if utility costs are high. This dynamic can reduce the number of units effectively available to voucher holders, even when nominal rents appear compliant.

Hickory’s Local Housing Market Context

Hickory sits at the crossroads of manufacturing, healthcare, and logistics employment, with steady population growth in recent years. While rents remain lower than in major metropolitan areas, supply constraints have tightened the market.

New multifamily construction has lagged behind demand, particularly for family-sized units. Local housing officials say this imbalance has increased competition for rentals that accept vouchers.

“Affordable units are disappearing faster than they’re being replaced,” said a regional housing advocate. “Fair Market Rents help, but they don’t solve supply shortages.”

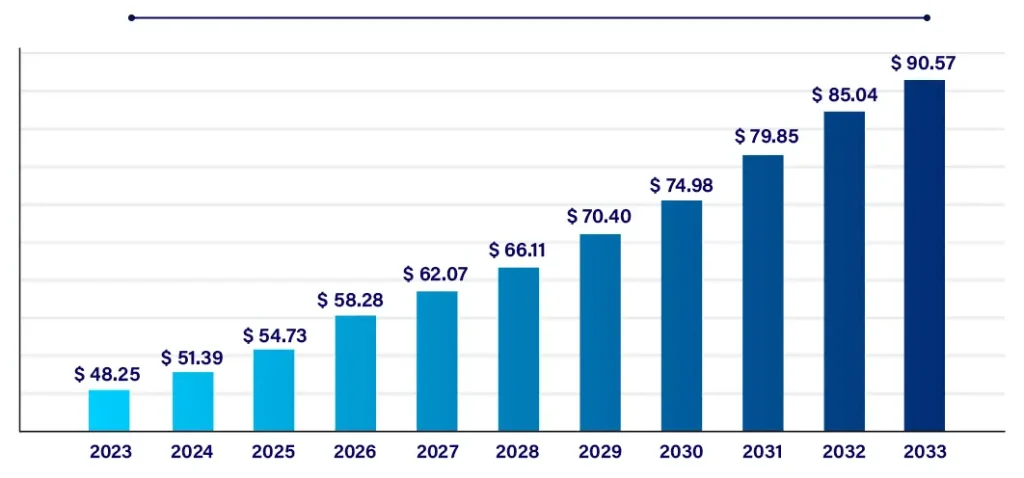

A Look Back: How Fair Market Rents Have Changed

Over the past decade, Fair Market Rents in the Hickory area have generally risen gradually, reflecting moderate inflation rather than sharp spikes. During periods of rapid rent growth nationwide, FMR increases have often lagged behind market realities.

Housing researchers note that this lag can make it harder for voucher holders to compete, especially when landlords can easily rent to unsubsidized tenants.

Landlord Participation: Incentives and Concerns

Landlords who participate in Section 8 benefit from:

- Reliable monthly payments backed by the federal government

- Lower vacancy risk

- Long-term tenant stability

However, some landlords cite administrative inspections, rent caps, and regulatory oversight as deterrents. As a result, participation rates vary widely by neighborhood.

Local housing authorities continue outreach efforts aimed at expanding landlord participation to increase voucher acceptance.

Policy Debate: Do Fair Market Rents Go Far Enough?

Critics argue that Fair Market Rents do not always reflect neighborhood-level rent variation, particularly in areas with mixed-income housing. Some advocate for broader use of Small Area Fair Market Rents, which adjust limits by ZIP code.

Supporters counter that overly granular rent standards could increase costs and administrative complexity without guaranteeing better outcomes.

What Comes Next for Hickory

HUD will release updated Fair Market Rents again later this year, based on new market data. Housing authorities will then reassess payment standards for 2026.

Much will depend on federal funding levels, inflation trends, and local housing supply. For now, Fair Market Rents in Hickory remain a central reference point for navigating affordability in the region.

FAQ

Are Fair Market Rents the same as average rents?

No. FMRs reflect the 40th percentile of rents, not the average or median.

Can landlords refuse Section 8 tenants?

North Carolina law allows landlords to decide whether to participate, unless local ordinances state otherwise.

Do Fair Market Rents cap all rents?

No. They apply primarily to federally assisted housing programs.

How often do FMRs change?

Once per year, unless HUD issues interim adjustments.