Credit repair for renters has become a critical pathway to securing private apartments in increasingly competitive housing markets, where landlords rely heavily on credit histories to reduce financial risk. As rent prices climb and vacancy rates remain tight, the practice—widely known as Credit Repair for Renters—now plays a central role in determining who qualifies for housing and who is left searching.

Table of Contents

Credit Repair for Renters

| Key Fact | Detail |

|---|---|

| Credit checks are standard | Most private landlords run credit reports |

| No legal minimum score | Approval thresholds vary by landlord |

| Rent often not reported | Positive rent history may not appear on reports |

| Rent reporting boosts scores | Some renters see gains in months |

The Growing Importance of Credit in Rental Housing

Over the past decade, private rental markets across the United States have undergone a structural shift. Rising home prices, higher mortgage rates, and delayed homeownership have pushed more households into long-term renting, according to the Joint Center for Housing Studies at Harvard University.

This demand has coincided with a tightening supply of rental units, particularly in urban and suburban markets. As a result, landlords face more applicants per unit and are increasingly selective.

“Credit reports give landlords a standardized, easily accessible snapshot of financial behavior,” said Dr. Alexander Hermann, a housing policy researcher at Harvard. “In tight markets, that snapshot often determines who advances and who does not.”

How Credit Repair for Renters Became Central to Screening

A Shift From Informal to Data-Driven Decisions

Historically, many landlords relied on references, interviews, and income verification. Credit checks existed but were often secondary. That balance has changed.

Tenant screening software now allows landlords to pull credit, eviction, and background data within minutes. Industry groups say this efficiency has made credit scores a primary decision-making tool.

According to the National Apartment Association, more than 90 percent of professionally managed properties now use formal credit screening as part of their application process.

What Credit Reports Signal to Landlords

Credit repair for renters focuses on improving elements landlords associate with reliability:

- Consistent on-time payments

- Low outstanding revolving debt

- Limited collections or charge-offs

While credit scores were designed to predict loan repayment, landlords use them as a proxy for rent payment behavior, despite ongoing debate about their accuracy in that role.

The Mechanics of Credit Repair for Renters

Payment History and Utilization

Consumer credit bureaus agree that payment history remains the single most influential factor in credit scoring models. Late payments, even by a few days, can lower scores and remain on reports for years.

Credit utilization—how much available credit is used—also plays a significant role. Housing counselors note that renters with modest incomes are often disproportionately affected, as higher utilization may reflect limited access to credit rather than financial irresponsibility.

“Many renters are penalized for structural issues, not risky behavior,” said Linda Jun, a certified housing counselor in California. “Credit repair is often about correcting that imbalance.”

Rent Reporting as a Structural Change

One of the most significant developments in credit repair for renters has been the expansion of rent reporting. Traditionally, rent payments were invisible to credit bureaus unless they became delinquent.

Rent reporting services now allow tenants to add positive payment data to their credit files. Studies from the Urban Institute show that renters with thin credit files often benefit the most, sometimes gaining dozens of points over several months.

However, participation remains voluntary, and not all landlords offer or support reporting programs.

Legal and Regulatory Context

What the Law Allows—and Does Not

There is no federal law setting minimum credit scores for rental housing. Landlords are generally free to establish their own screening criteria, provided they comply with fair housing laws.

The Fair Housing Act prohibits discrimination based on race, color, religion, sex, disability, familial status, or national origin. While credit screening is legal, housing advocates argue that it can have disparate impacts on protected groups.

The Consumer Financial Protection Bureau has cautioned landlords to ensure screening practices are applied consistently and transparently.

State and Local Variations

Some states and cities have begun to regulate tenant screening more closely. Limits on application fees, requirements for adverse action notices, and restrictions on using certain types of debt—such as medical collections—have emerged in several jurisdictions.

“These policies aim to balance landlord risk with tenant access,” said Rachel Kleinman, a housing law professor at Georgetown University. “Credit repair alone cannot solve systemic barriers, but regulation can mitigate them.”

The Human Impact of Credit Repair for Renters

Renters Navigating the System

For renters, credit repair often intersects with broader financial recovery. Medical emergencies, job losses, or pandemic-related disruptions have left lasting marks on credit reports.

“I never missed rent, but my credit score dropped after a hospital bill went to collections,” said Maria Lopez, a renter in Phoenix. “That followed me when I applied for a new apartment.”

Housing advocates note that such experiences are common, reinforcing calls for broader data used in rental decisions.

Landlord Perspectives

Landlords, particularly small property owners, say credit checks provide necessary protection in a high-cost environment.

“A single missed rent payment can mean thousands in losses,” said Thomas Greene, who owns several rental units in Ohio. “Credit history is one of the few tools we have to manage that risk.”

Industry groups argue that eliminating credit screening altogether could raise rents, as landlords price in higher uncertainty.

Economic Disparities and Geographic Differences

Credit repair for renters plays out unevenly across regions. In high-cost cities such as New York, San Francisco, and Boston, landlords often impose stricter thresholds due to strong demand.

In contrast, smaller markets may allow greater flexibility, placing more weight on income or references.

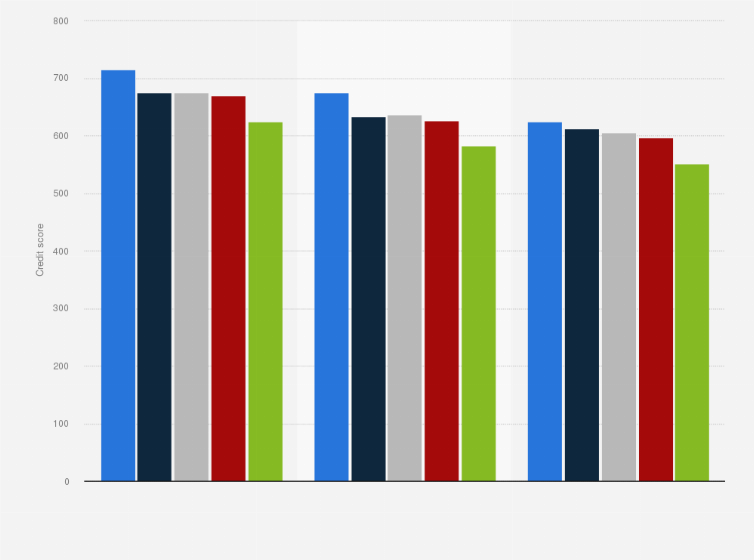

Research from the Federal Reserve shows that average credit scores vary significantly by region, reflecting broader economic inequality. Housing experts warn that uniform screening standards may unintentionally exclude qualified renters in lower-income areas.

The Policy Debate: Reform or Reinforcement?

Housing policymakers remain divided on the role credit should play in rental markets. Some argue for expanded rent reporting and alternative data, such as utility payments, to make credit systems more inclusive.

Others caution that adding more data could increase surveillance and penalize vulnerable renters.

“The goal should be accuracy, not exclusion,” said Dr. Emily Carter, a senior fellow at the Brookings Institution. “Credit repair for renters works best when paired with systemic reform.”

Looking Ahead

As rental demand remains strong and economic uncertainty persists, credit repair for renters is likely to remain a defining feature of the private housing landscape. Technology, policy, and market forces will continue to shape how credit data is used—and how much it determines access to housing.

For now, renters, landlords, and regulators alike are navigating a system in transition, one where financial history increasingly dictates where people can live.

FAQ

Does credit repair for renters guarantee approval?

No. Credit is only one factor, alongside income and rental history.

Can rent payments improve credit?

Yes, if reported to credit bureaus through landlords or rent reporting services.

Are landlords required to disclose credit criteria?

Practices vary, but adverse action notices are often required when applications are denied.