Renters insurance in subsidized housing is often misunderstood as optional or unnecessary, particularly among tenants whose rent is reduced through government assistance. Housing officials, legal experts, and insurers say that assumption leaves millions of renters financially exposed. While subsidies lower monthly rent, they do not cover personal belongings, legal liability, or temporary housing costs after disasters.

Table of Contents

Renters Insurance 101

| Key Fact | Detail |

|---|---|

| Landlord insurance | Covers structure, not tenant belongings |

| Average renters insurance cost | $15–$25 per month nationally |

| Typical liability coverage | $100,000–$300,000 |

As housing markets tighten and climate risks increase, experts expect renters insurance to play a larger role in housing stability discussions. For tenants in subsidized housing, understanding what assistance covers—and what it does not—may become increasingly essential to long-term security.

What Renters Insurance Covers — and Why It Exists

Renters insurance was developed to address a structural gap in rental housing protection. Landlords insure buildings. Homeowners insure property they own. Renters, unless they purchase insurance themselves, are left unprotected.

Standard renters insurance policies include three main components.

Personal property coverage reimburses tenants for belongings damaged or stolen due to covered events such as fire, smoke, theft, vandalism, or certain types of water damage. This can include clothing, furniture, electronics, and appliances owned by the tenant.

Personal liability coverage pays medical or legal costs if a tenant is found responsible for injury to another person or damage to someone else’s property. This includes incidents such as a guest slipping inside the apartment or accidental water damage affecting a neighboring unit.

Additional living expenses coverage pays for temporary housing, meals, and basic necessities if a rental unit becomes uninhabitable due to a covered loss.

Policies typically exclude floods and earthquakes unless separate coverage is purchased.

Subsidized Housing Changes Rent — Not Risk

Federal and state housing assistance programs are designed to make rent affordable, not to absorb personal financial risk. That distinction is often unclear to tenants.

Public housing, Housing Choice Vouchers (commonly known as Section 8), and Low-Income Housing Tax Credit (LIHTC) properties all operate under different funding structures. None, however, include insurance protection for tenant belongings or liability.

“Subsidies are about access to housing, not insurance,” said Dr. Maria Thompson, a housing policy scholar at a major U.S. university. “From a legal standpoint, tenants in subsidized housing are treated the same as any other renter when it comes to responsibility for damage or injury.”

When Things Go Wrong: Common Loss Scenarios

Housing advocates point to recurring situations where renters insurance becomes critical.

In multi-unit buildings, cooking fires are among the most common causes of displacement. Even when a fire originates in another unit, smoke and sprinkler damage can destroy personal belongings throughout the building.

Theft is another frequent issue. While landlords may repair damaged doors or windows, stolen items are the tenant’s responsibility without insurance.

Water damage from burst pipes or overflowing fixtures can also trigger liability disputes. If investigators determine a tenant’s negligence contributed to the damage, they may be held financially responsible for repairs affecting other units.

Why More Landlords Are Requiring Renters Insurance

In recent years, housing authorities and nonprofit landlords have increasingly required renters insurance as part of lease agreements. The shift reflects rising repair costs, legal claims, and insurance premiums for property owners.

Landlords say the requirement reduces conflict after incidents and ensures tenants have a means to recover losses without litigation.

Federal housing guidance allows such requirements as long as they are applied uniformly and do not discriminate against protected classes. Tenants typically retain the right to choose their insurer and coverage limits.

The Cost Question: Is Renters Insurance Affordable?

Affordability remains a legitimate concern for low-income households. However, insurance regulators note that renters insurance is among the least expensive consumer insurance products.

According to industry data, the national average annual premium is under $300. Policies with lower coverage limits can cost significantly less, especially in areas with lower crime rates or newer construction.

Insurance pricing reflects risk factors such as building location, claim history, and coverage amount. Subsidized housing status alone does not increase premiums.

Consumer advocates stress that the cost of replacing even basic household items often exceeds several years of premiums.

Climate Risks Are Raising the Stakes

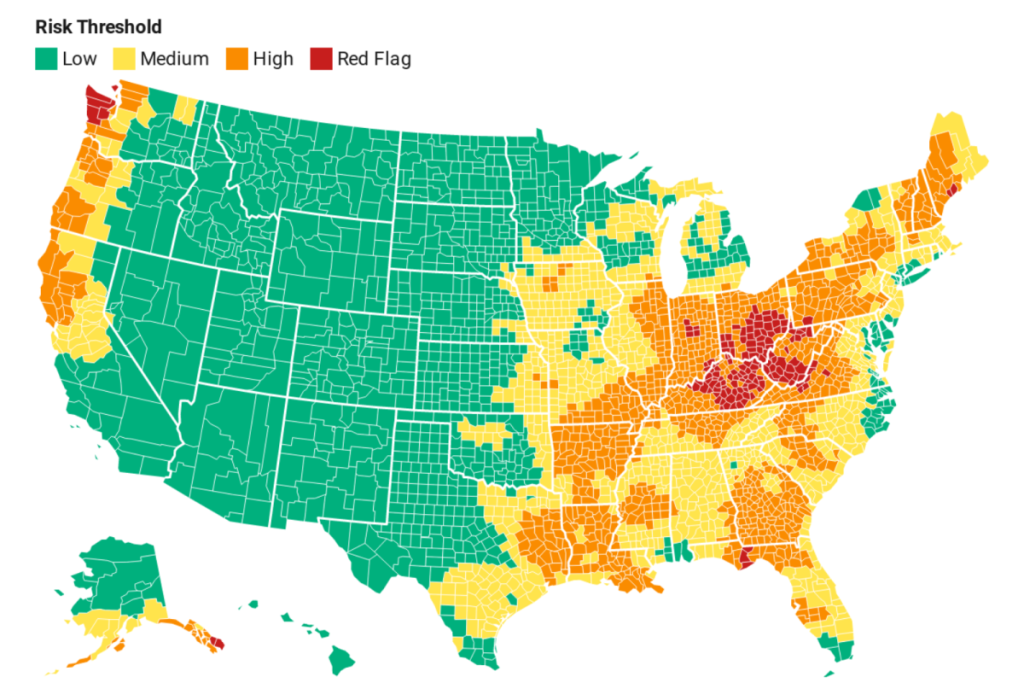

Climate-related disasters are increasingly affecting renters, including those in subsidized housing. Extreme heat, wildfires, and severe storms are driving more evacuations and temporary displacements.

While renters insurance does not cover flood damage without an endorsement, it often covers fire-related losses and living expenses following mandatory evacuations.

As climate risk grows, housing experts warn that uninsured renters are more vulnerable to long-term displacement after disasters.

Legal Reality: Liability Does Not Disappear With Subsidies

Court records show that tenants in subsidized housing can be named in lawsuits related to personal injury or property damage, regardless of income level.

Legal aid organizations report that uninsured tenants often face wage garnishment or debt judgments after incidents involving injury or extensive damage.

“Liability coverage is often overlooked until it’s too late,” said James Holloway, a housing attorney with two decades of experience in tenant defense. “People assume they’re protected because their housing is subsidized, but the courts don’t see it that way.”

Barriers to Access and Consumer Protections

Despite its benefits, renters insurance uptake remains low among low-income renters. Barriers include lack of awareness, distrust of insurers, and difficulty navigating policy terms.

Some states require insurers to provide plain-language disclosures explaining coverage and exclusions. Consumer advocates are pushing for clearer policy summaries and multilingual materials.

Nonprofit housing groups have begun partnering with insurers to offer education sessions and group-rate policies in subsidized developments.

Should Renters Insurance Be Subsidized?

The question of whether renters insurance should be publicly subsidized is gaining attention among policymakers.

Supporters argue that modest subsidies could prevent homelessness by reducing post-disaster displacement and legal debt. Critics caution against expanding public obligations beyond housing assistance.

No federal program currently subsidizes renters insurance premiums, though pilot initiatives have been proposed at the local level.

FAQ

Is renters insurance mandatory in subsidized housing?

Not under federal law, but landlords may require it through lease agreements.

Does renters insurance affect housing assistance eligibility?

No. Insurance premiums do not count as income and do not reduce housing benefits.

Are pets covered by renters insurance?

Policies typically cover liability related to pets, but not damage to the tenant’s own property caused by animals.

What happens if I cannot afford renters insurance?

Some landlords offer grace periods or referrals to nonprofit assistance programs, but requirements vary.