As housing costs continue to outpace wages across much of the United States, guaranteed rent arrangements linked to federal housing vouchers are gaining traction in 2026, offering landlords predictable income streams while playing a growing role in stabilizing the nation’s strained rental market.

Table of Contents

Housing Vouchers in 2026

| Key Fact | Detail / Statistic |

|---|---|

| Households using vouchers | Over 2.3 million U.S. households |

| Tenant rent contribution | ~30% of adjusted household income |

| Average landlord payment reliability | Payments issued monthly by housing authorities |

| States with source-of-income protections | 15+ states, dozens of cities |

| Average wait time for vouchers | Often 2–5 years in major metros |

What Guaranteed Rent Means in the U.S. Rental System

Guaranteed rent is not a single federal program but a term increasingly used to describe rental income that is largely assured by a government entity rather than dependent solely on tenant earnings. In the United States, this guarantee most commonly comes through the Housing Choice Voucher program, administered by the Department of Housing and Urban Development (HUD).

Under the program, tenants pay a fixed portion of their income—typically about 30 percent—toward rent. Local public housing authorities then pay the remaining balance directly to landlords each month, up to a locally determined payment standard tied to Fair Market Rent.

For landlords, the arrangement reduces exposure to income shocks such as job loss or medical emergencies that can disrupt private-market rent payments. For tenants, it provides access to housing that would otherwise be unaffordable.

HUD data show that voucher holders include working families, seniors on fixed incomes, people with disabilities, and veterans. Contrary to persistent misconceptions, the majority of voucher recipients are either employed or unable to work due to age or disability.

Why Guaranteed Rent Is Drawing New Interest in 2026

Rising Costs and Narrower Margins

The renewed interest in guaranteed rent comes amid a challenging environment for property owners. Mortgage rates remain elevated compared with pre-pandemic levels, insurance premiums have risen sharply in disaster-prone regions, and maintenance costs continue to climb due to labor shortages and higher material prices.

“In many markets, landlords are less focused on maximizing rent and more focused on minimizing risk,” said Mark Willis, a senior policy fellow at New York University’s Furman Center. “Guaranteed rent offers certainty in a period of financial unpredictability.”

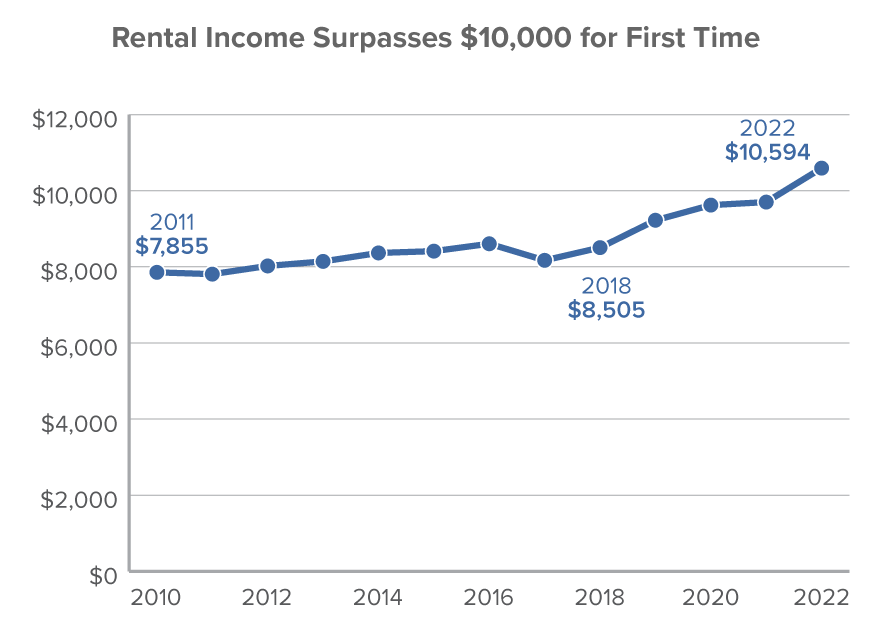

Industry analysts note that even modest payment delays can strain smaller landlords, who own the majority of U.S. rental properties. Guaranteed rent, by contrast, arrives on a fixed schedule, often through direct deposit.

Lower Vacancy Rates and Consistent Demand

Another factor driving interest is demand. Housing voucher holders face long waitlists and limited unit availability, particularly in high-cost metropolitan areas. As a result, properties that accept vouchers often lease faster than comparable units that do not.

According to data compiled by several regional housing authorities, voucher-eligible units in cities such as Phoenix, Atlanta, and Cleveland experience vacancy periods that are, on average, 20 to 30 percent shorter than market-rate-only units.

Property managers say the predictability of demand reduces marketing costs and turnover. “You rarely struggle to find a qualified tenant,” said a Chicago-based multifamily operator who recently expanded voucher participation across several properties.

Policy Changes Reshaping Landlord Decisions

Expansion of Source-of-Income Protections

Legal changes are also influencing landlord behavior. As of 2026, more than a dozen states—including California, New York, and New Jersey—along with dozens of cities and counties, prohibit landlords from rejecting tenants solely because they use housing vouchers.

These source-of-income protections aim to curb discrimination that housing advocates say has historically limited voucher effectiveness. While enforcement varies by jurisdiction, housing law experts say the trend is clear.

“What we’re seeing is a normalization of voucher acceptance,” said Paula Franzese, a professor at Seton Hall University School of Law. “As legal risk increases, landlords are reassessing long-standing assumptions about the program.”

Federal Funding Uncertainty

At the same time, guaranteed rent programs face ongoing funding challenges. Congressional budget negotiations have raised concerns about whether voucher funding will keep pace with rising rents and inflation.

The National Low Income Housing Coalition has warned that flat or reduced funding could force housing authorities to cut assistance or freeze new enrollments. Such outcomes would directly affect landlords who rely on voucher-backed payments.

HUD officials say they continue to work with Congress to maintain program stability, emphasizing that housing vouchers remain one of the federal government’s most effective tools for preventing homelessness.

Administrative Requirements and Landlord Concerns

Inspections and Compliance

Participation in voucher programs comes with obligations. Units must meet HUD’s Housing Quality Standards, which address basic safety, sanitation, and habitability. Inspections are required before move-in and periodically thereafter.

Some landlords cite inspection delays as a drawback, particularly in jurisdictions with staffing shortages. However, housing authorities argue that inspection standards largely mirror local building codes and protect long-term property value.

“The standards are not luxury requirements,” said a spokesperson for a large Midwestern housing authority. “They ensure homes are safe and livable.”

Rent Limits in High-Cost Markets

Voucher payments are capped at Fair Market Rent levels, which are adjusted annually and vary by region. In rapidly appreciating markets, these limits may fall below prevailing rents, discouraging participation.

To address this issue, HUD has expanded the use of Small Area Fair Market Rents, which more closely reflect neighborhood-level pricing. While the change has improved access in some areas, gaps remain in high-demand districts.

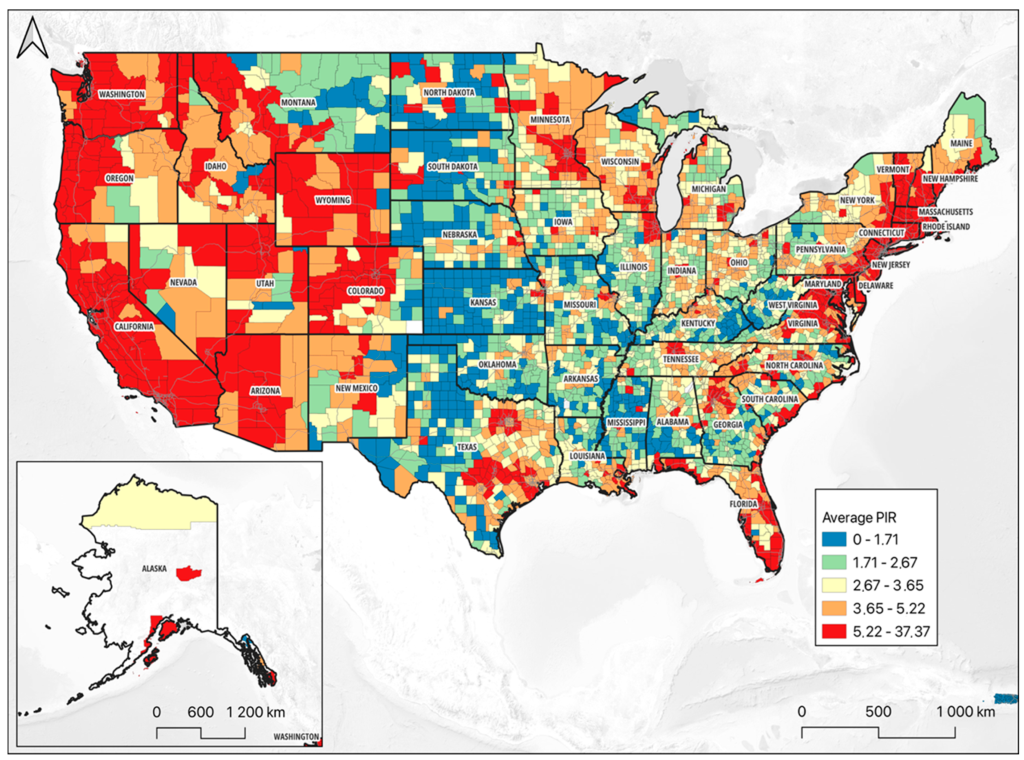

Economists note that voucher participation is highest in moderate-cost markets, where payment standards align more closely with private rents.

Historical Context: How Perceptions Are Changing

Housing vouchers have existed in various forms since the 1970s, but landlord participation has fluctuated with economic cycles and political sentiment. During periods of strong rental demand, landlords often avoided vouchers. During downturns, interest tended to rise.

What distinguishes 2026, analysts say, is the convergence of legal, economic, and demographic factors. Rental affordability has deteriorated across income levels, while public policy increasingly frames housing stability as an economic necessity rather than solely a social issue.

“There’s a growing recognition that housing instability affects labor markets, health outcomes, and public spending,” said an economist at the Urban Institute. “Guaranteed rent fits into that broader conversation.”

Regional Differences Across the United States

Participation in guaranteed rent programs varies widely by region. In parts of the Midwest and South, where rents remain relatively affordable, voucher acceptance is common and often viewed as routine.

In coastal cities, participation is more uneven. High rents, limited inventory, and stronger competition for units can reduce landlord incentives, even with legal protections in place.

Rural areas face a different challenge altogether. Limited housing stock and aging properties can make compliance difficult, despite strong demand from voucher holders.

The Tenant Perspective

For tenants, guaranteed rent arrangements provide stability in an otherwise volatile housing market. Voucher holders are less likely to experience eviction and more likely to remain housed long term, according to multiple academic studies.

Stable housing, in turn, is linked to improved educational outcomes for children, better health indicators, and greater workforce participation among adults.

“Housing is the platform on which everything else rests,” said Diane Yentel, president of the National Low Income Housing Coalition. “When landlords participate, the benefits ripple outward.”

Looking Ahead: What 2026 and Beyond May Bring

The future of guaranteed rent will depend on several factors, including federal budget decisions, local enforcement of fair housing laws, and broader economic conditions.

Housing authorities are experimenting with incentives such as signing bonuses, damage mitigation funds, and streamlined inspections to attract more landlords. Early results suggest these measures can improve participation without significant additional cost.

Analysts say that while guaranteed rent will not solve the nation’s housing shortage, it may play a growing role in stabilizing the lower end of the rental market.

“The system isn’t perfect,” Willis said, “but in an era of uncertainty, predictability has value—for landlords, tenants, and communities alike.”

FAQ

What is guaranteed rent?

Guaranteed rent refers to rental income that is reliably paid, often through government-backed housing voucher programs.

Is guaranteed rent the same as Section 8?

Section 8 is the most common Housing Choice Voucher program, but guaranteed rent can also describe similar local initiatives.

Can landlords still screen tenants?

Yes. Landlords may apply standard screening criteria, provided they comply with fair housing and source-of-income laws.

Are voucher payments ever late?

Payments are generally consistent, though administrative delays can occur during initial setup or policy changes.