Hidden History of U.S. Government Housing: The Hidden History of U.S. Government Housing isn’t just a dusty tale in a textbook — it’s real, raw, and still relevant today. From the dusty streets of the 1930s to the towering housing crises of the 2020s, government housing policy has been a battleground of race, class, politics, and survival. Some folks were lifted up by these policies — helped into homes, protected from poverty. Others were boxed out — shut off by racism, ignored by bureaucracy, or left behind by politics. This story is about all of them — and what it means for you and me today.

Table of Contents

Hidden History of U.S. Government Housing

The hidden history of U.S. government housing is a story of hope, harm, help — and hard lessons. It’s about how policies shaped people’s lives, often in ways they never chose. From redlining to rent vouchers, from public towers to tax credits, we’ve seen the government step in — sometimes boldly, sometimes badly. The question now is: what comes next? Affordable housing isn’t just an economic issue. It’s a justice issue. A family issue. A survival issue. And it’s one that we, as a country, can choose to fix — if we have the will.

| Topic | Stat/Fact | Why It Matters |

|---|---|---|

| Federal Housing Support | ~4.5 million households receive HUD housing assistance | Massive scale — yet still not enough to meet demand |

| Public Housing Units | ~970,000 units of public housing still active | Direct government involvement in housing remains significant |

| Rent Burden | 31.3% of U.S. households spend 30%+ of income on housing | Renters and buyers alike are under economic pressure |

| Homelessness in 2024 | 653,100+ homeless people — highest since counting began | Evidence of growing housing instability |

| Key Historical Laws | National Housing Act (1934), Housing Act (1937), Fair Housing Act (1968), Section 8 (1974), LIHTC (1986) | Timeline shows consistent policy shifts and impact |

| Official Source | HUD Website | https://www.hud.gov |

A Deep Dive into the Early Years: The Great Depression’s Wake-Up Call

When the Great Depression hit in the 1930s, housing was in chaos. Banks collapsed, mortgages defaulted, and entire neighborhoods emptied out.

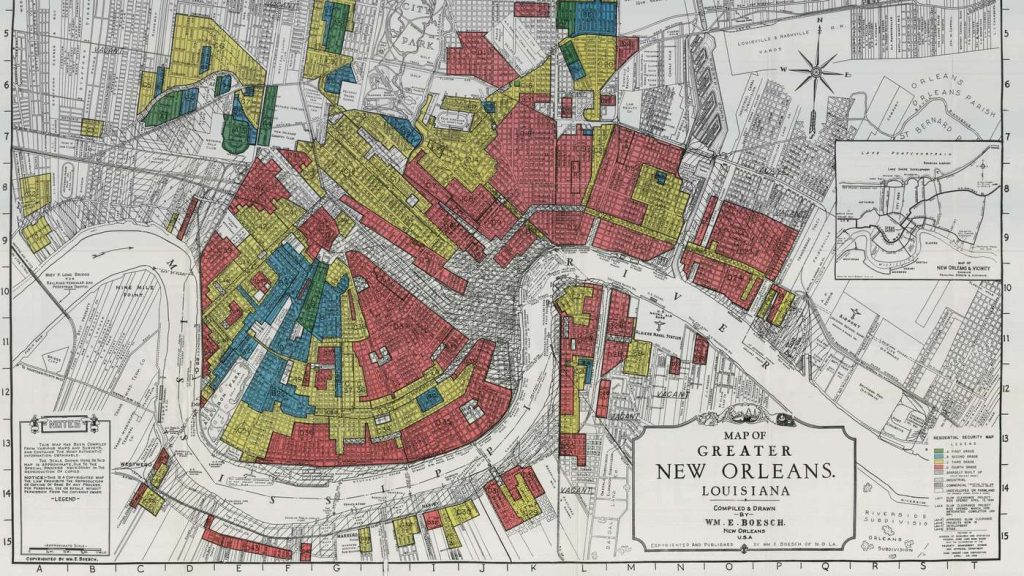

So the federal government stepped in. The National Housing Act of 1934 wasn’t flashy — but it was revolutionary. It created the Federal Housing Administration (FHA) and Home Owners Loan Corporation (HOLC) — helping stabilize the market and spark homeownership.

But here’s where it gets messy:

The FHA also drew “redlining maps” — literally coloring Black neighborhoods red, labeling them too risky for investment. That meant Black families were denied mortgages — shutting them out of homeownership, while white families built generational wealth in the suburbs.

Public Housing Begins — Then Gets Complicated

The Housing Act of 1937 launched public housing as we know it. But while the goal was to give working-class folks a decent place to live, the rules were built on local control — and local politics often meant segregated housing, poor maintenance, and zero accountability.

Public housing was rarely built in wealthy neighborhoods. Often, it was used as a tool to clear out “slums” — which really meant displacing Black and immigrant families in inner cities. The promise was a fresh start, but the reality was confinement and isolation.

Postwar Prosperity — But Not For Everyone

After World War II, the GI Bill helped white veterans buy homes — but excluded Black veterans in practice. FHA loans fueled a suburban boom, but only if you were white and middle-class. If not? You were left behind — still paying rent, still shut out from equity.

By the 1950s and ‘60s, public housing turned into a last resort, rather than a launching pad. Underfunding, poor design, and economic neglect turned some developments into high-poverty zones with few resources.

HUD, Civil Rights, and the Turning Point of 1968

In 1965, President Lyndon B. Johnson formed the Department of Housing and Urban Development (HUD) — bringing together housing, urban planning, and civil rights goals under one cabinet agency.

Three years later, the Fair Housing Act of 1968 made it illegal to discriminate based on race, religion, or national origin in housing sales, rentals, and loans.

It was a huge step forward, but enforcement was weak. Segregated neighborhoods stayed segregated. And the supply of affordable housing? Still far too small.

From Projects to Vouchers: The Rise of Section 8

In the 1970s, housing policy took a turn. Instead of building big public housing complexes, the government started offering rental subsidies through a new program: Section 8.

With Section 8, low-income families could use vouchers to rent homes in the private market. It gave them more freedom to choose where to live — at least in theory.

But in practice:

- Vouchers were hard to get — waitlists could be years long.

- Many landlords refused to accept them.

- The number of available affordable units didn’t match the demand.

Today, Section 8 helps about 2.3 million households — but millions more are eligible and don’t get help.

A New Strategy: Tax Credits and Public-Private Deals

In 1986, Congress passed the Low-Income Housing Tax Credit (LIHTC). It gave big tax breaks to developers who agreed to build or renovate affordable housing.

Sounds like a win-win, right?

Well — sort of. LIHTC helped create 3 million+ affordable units, but critics say:

- Many units convert to market-rate after 15-30 years.

- Developers still focus on higher-income brackets within the “affordable” range.

- Poorer families are often left out unless local programs fill the gap.

It also shifted power from public agencies to private investors, changing how affordable housing was controlled and funded.

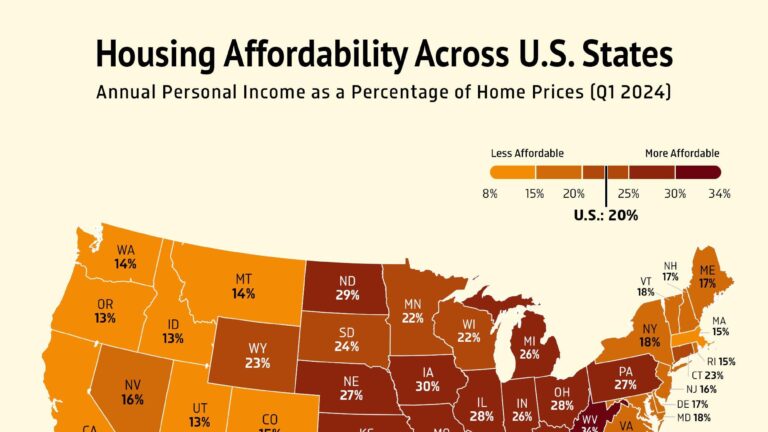

The Modern Crisis: Too Few Homes, Too Much Rent

Fast forward to today: we’re in a full-blown housing affordability crisis.

Here’s what we’re up against:

- No state has enough affordable rental housing for extremely low-income renters

- More than half of renters pay over 30% of income on housing

- In many cities, minimum wage workers need to work 2-3 full-time jobs to afford a modest apartment

Meanwhile, homelessness has hit record levels, especially in states like California, New York, and Washington. Rising rents, evictions, and lack of mental health support all feed the crisis.

How the Hidden History of U.S. Government Housing Still Shapes the Present?

We can’t talk about the future of housing without reckoning with its past.

Redlined neighborhoods from 80 years ago still have lower home values, fewer services, and worse outcomes.

Black and Latino homeownership lags far behind white families — due to the legacy of lending discrimination.

Zoning laws in many cities still block apartment buildings in single-family zones — limiting density and affordability.

The policies were deliberate. The damage was structural. And to fix it? We need structural solutions.

Case Study: What It Looks Like on the Ground

In Los Angeles, a tenant on Section 8 spent four years on a waitlist, finally received her voucher, but couldn’t find a landlord to accept it in time. She lost the voucher.

In Chicago, public housing projects like Cabrini-Green were demolished — meant to reduce crime and integrate communities. But thousands of residents were displaced, with little guarantee of return.

In Minneapolis, the city abolished single-family zoning in 2020 — opening the door for multi-unit development and more diverse housing options.

These examples show the human side of housing policy — where lives are shaped by laws written in distant offices.

Hidden History of U.S. Government Housing: What You Can Do (Practical Steps)

Whether you’re a tenant, advocate, policymaker, or just a curious citizen — you’ve got power.

- Check your eligibility

Visit hud.gov or your local housing authority to learn if you qualify for programs like Section 8, public housing, or FHA-backed loans. - Know your rights

If you’re facing discrimination in housing, you can file a complaint through HUD’s Fair Housing Office. - Get involved locally

Zoning changes happen at city council meetings. So do eviction protections. Show up. Speak up. - Advocate for funding

Housing needs more money, not less. Contact your reps to support increased HUD budgets, LIHTC expansion, and enforcement of fair housing.