The Hidden Path to Low-Income Housing Loans: When it comes to owning a home or even just finding a decent place to rent without emptying your pockets every month, many folks in America feel stuck. If you’ve ever thought, “I’ll never qualify for a home loan,” or “Affordable housing just isn’t for people like me,” let’s pause right there. There’s a good chance you’ve been misinformed. In fact, you might be closer to qualifying for low-income housing loans or affordable rental programs than you realize — and you could qualify without knowing it. In this guide, we’ll walk through the hidden path to homeownership and rental security that most people miss out on — simply because no one broke it down for them clearly. Whether you’re a working single parent, a young adult trying to leave the rental cycle, or a community leader helping others, this article lays out what programs exist, how they work, who qualifies, and what to do next.

Table of Contents

The Hidden Path to Low-Income Housing Loans

The path to homeownership or stable, affordable housing isn’t just for the wealthy or the lucky. It’s for anyone willing to take the first step, learn about these programs, and apply. With options like USDA loans, FHA-backed mortgages, Section 8 vouchers, and public housing, many families — just like yours — have moved into homes they never thought they could afford. So if you’ve been on the fence, unsure if you “qualify,” take this as your sign: you might qualify and not know it.

| Topic | What You Should Know |

|---|---|

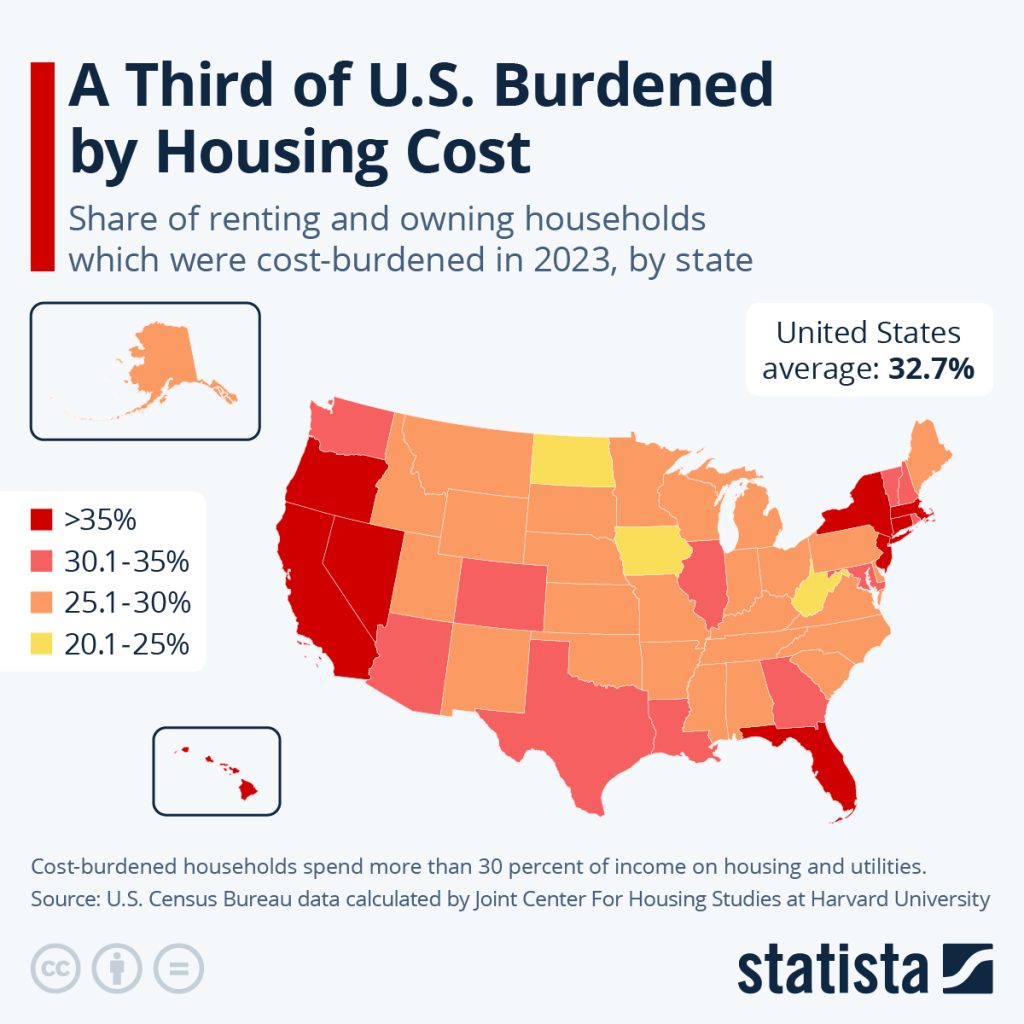

| Cost-burdened Americans | Over 31% of households pay more than 30% of income toward housing |

| Housing Choice Vouchers | 2.3M families currently use vouchers to rent homes |

| Public Housing | ~970,000 families live in publicly owned housing units |

| LIHTC Impact | Created over 3.6M affordable rental units since 1987 |

| USDA Rural Housing Loans | Loans available with 0% down payment in eligible rural areas |

| HUD Income Limit Tool | Helps you check eligibility by state & household size |

The American Housing Crisis: Why Affordable Options Are Crucial

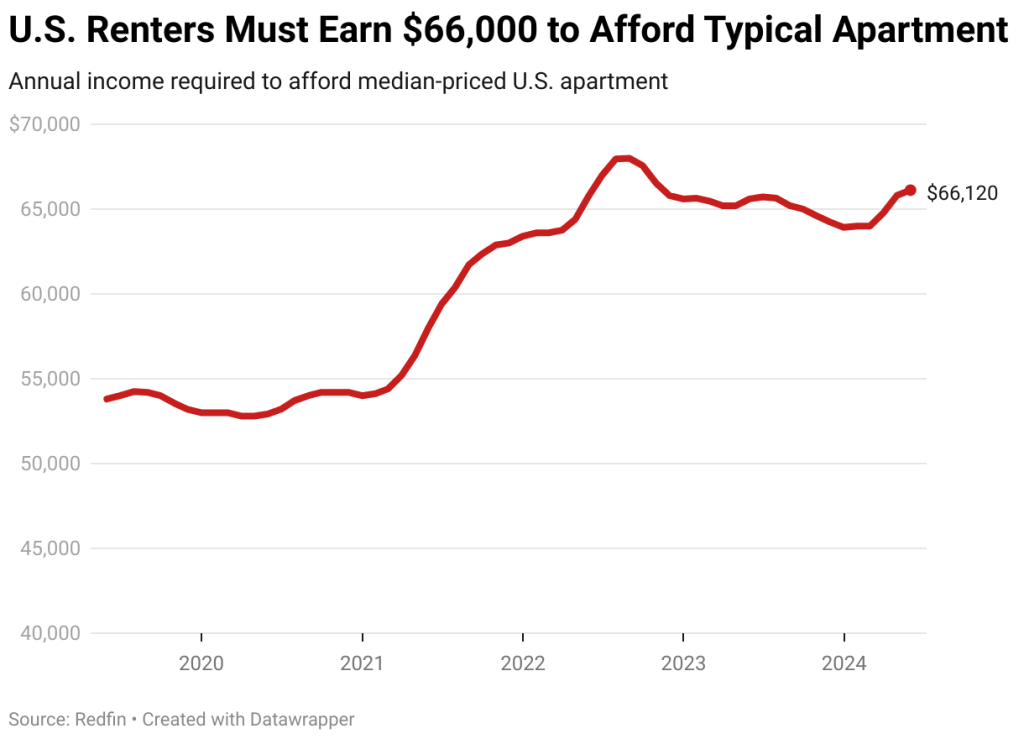

Let’s not sugarcoat it — housing in the U.S. is in crisis mode for many low- and middle-income families. The National Low Income Housing Coalition (NLIHC) reports that a full-time worker must earn $28.58/hour to afford a modest two-bedroom rental — nearly double the federal minimum wage.

More than 11 million households are considered “severely cost-burdened,” meaning they spend over 50% of their monthly income on housing.

Add rising interest rates, inflation, and stagnant wages, and you’ve got a recipe for generations locked out of homeownership — unless they know where to look for help.

What Exactly Are Low-Income Housing Loans?

These are government-backed or government-assisted loans that offer lower interest rates, more forgiving credit requirements, and little to no down payment. In some cases, these loans are directly provided by federal agencies or made through private lenders with federal guarantees.

There are also non-loan-based housing assistance options like vouchers, grants, and subsidies that help renters secure affordable homes while they work on credit or savings goals.

The key programs include:

- USDA Single Family Housing Programs

- Federal Housing Administration (FHA) Loans

- HUD Housing Choice Voucher Program

- Public Housing

- Low-Income Housing Tax Credit (LIHTC)

- VA Housing Loans (for eligible veterans and families)

- HOME Investment Partnerships Program

- State and Local First-Time Homebuyer Programs

Let’s dive into what each one offers — and how you can apply.

USDA Loans — The Rural Dream

The USDA Single Family Housing Direct Loan Program (also called Section 502) helps very low- and low-income families in eligible rural areas.

What makes this loan a game-changer?

- 0% down payment

- Interest rates as low as 1% with subsidies

- 30- to 38-year loan terms

- No mortgage insurance required

Many people assume USDA means “farmland only,” but in reality, about 97% of U.S. land is eligible under USDA definitions — including suburban areas.

FHA Loans — Homeownership With Less Than Perfect Credit

Offered through approved lenders but insured by the Federal Housing Administration, FHA loans allow buyers with credit scores as low as 580 to qualify for just 3.5% down payments. Even if you’ve had past bankruptcies or spotty credit, you may still qualify.

FHA loans are especially popular among first-time homebuyers and are available nationwide — not limited to income or geography, though they do have loan limits.

HUD Housing Choice Voucher Program (Section 8)

This program helps families rent private apartments by subsidizing the cost. The tenant pays 30% of their income, and the rest is covered by the voucher. This program:

- Allows freedom of location

- Serves 2.3 million households

- Prioritizes veterans, disabled individuals, and low-income families

But demand is high. Waiting lists can be long. Apply through your local Public Housing Agency (PHA).

Public Housing — Affordable Rental Units

Public housing is managed by local agencies and funded by HUD. These units are meant for low-income families, the elderly, and people with disabilities. Monthly rent is typically set at 30% of your adjusted income.

There are around 970,000 public housing units in the U.S., but like vouchers, demand is high and lists fill quickly.

Eligibility varies by location, so check your local housing authority for availability and application steps.

Low-Income Housing Tax Credit (LIHTC) Properties

While not a loan to the individual, LIHTC helps developers build housing where rents are restricted to a percentage of local income limits.

You apply directly to LIHTC properties, which may be managed by private landlords but are bound by affordability rules.

VA Loans — A Special Option for Veterans

If you’re a U.S. veteran, service member, or eligible surviving spouse, VA loans offer unbeatable benefits:

- 0% down payment

- No private mortgage insurance (PMI)

- Lenient credit score requirements

VA loans are available through private lenders and backed by the Department of Veterans Affairs.

HOME Investment Partnerships Program

This federal grant helps states and cities fund:

- Low-income housing construction

- Tenant-based rental assistance

- First-time homebuyer support

You can benefit through down payment help, repair loans, or affordable units, depending on your local agency’s implementation.

How Do You Know If You Qualify for The Hidden Path to Low-Income Housing Loans?

Here’s what most programs will look at:

- Your income vs. area median income (AMI) – HUD sets AMI limits annually

- Family size

- Location (city, suburb, rural)

- Citizenship or immigration status

- Credit history (varies by loan type)

Steps to Get Started

- Decide if you’re buying or renting

- Check your income and family size

- Find your local housing authority or approved lender

- Gather documents: ID, pay stubs, tax returns, bank statements

- Apply and follow up — waitlists can take months